This site is also available on:

Deutsch

For the first time, the new format also offers global analyses of the low-cost market, as well as further classifications and evaluations. Focus: aviation and transport.

Analysis of low-cost air transport: trends and developments 2024/25

With the “MONITOR Air Transport and Low-Cost,” the German Aerospace Center (DLR) offers a comprehensive analysis of current developments in the field of low-cost transport. This new format replaces the well-established “DLR Low Cost Monitor” publication series and provides stakeholders, policymakers, and industry with a solid basis for market observation.

Global development of air traffic

In 2024, approximately 4.7 billion passengers were counted worldwide, representing an increase of two percent compared to 2019. The number of flights worldwide amounts to approximately 36.3 million, which is still approximately five percent below pre-crisis levels. Of these, approximately eleven million flights are in the low-cost segment.

International market shares have shifted significantly since 2010. Asia, which long held third place, now leads the rankings with 31 percent, followed by North America with 29 percent and Europe with 23 percent of all global passenger flights. The low-cost sector is experiencing strong growth, with a share of approximately 35 percent in Europe and Asia and 25 percent in North America.

The largest global airlines in the low-cost market

Among the 25 largest airlines worldwide in June 2025, there are also four low-cost carriers: Southwest Airlines (USA) in fourth place, Ryanair (Europe) in fifth place, JetBlue (USA) in 19th place and Azul (South America) in 22nd place. This shows that the low-cost segment is now an integral part of the aviation market and is no longer a niche offering.

The DLR also publishes detailed monthly analyses of global air traffic in the “Global Aviation Monitor.” In Germany and Europe, scheduled passenger air traffic is operated by over 300 airlines at more than 600 airports, while there are over 4,000 airports and approximately 800 airlines worldwide. More than 100 companies belong to the low-cost segment.

European developments: Germany in fifth place

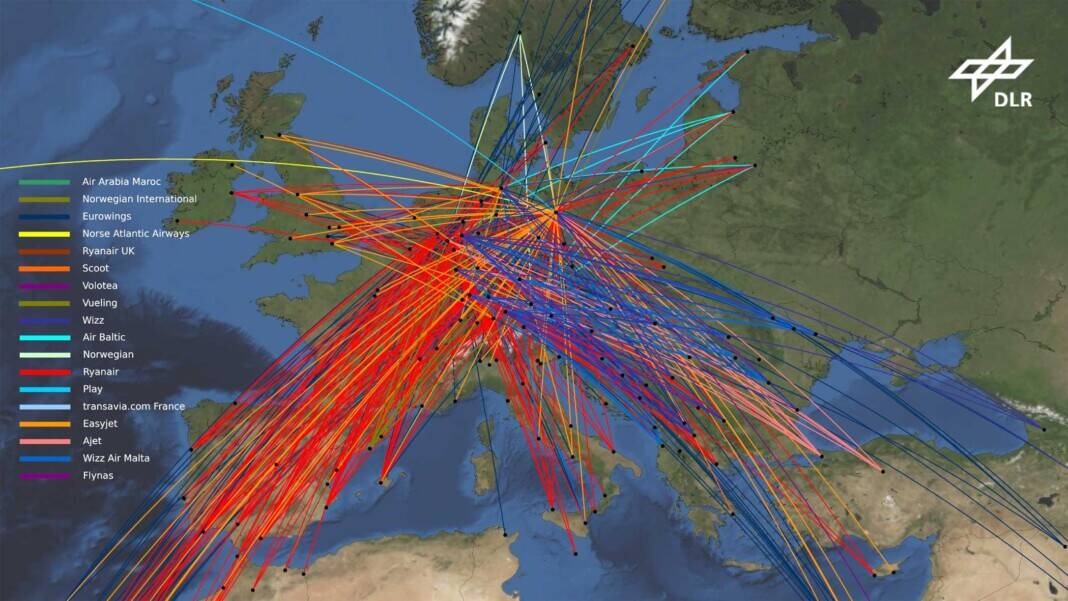

In a reference week in January 2025, over 38,000 low-cost flights were counted in Europe on almost 7,000 routes in 44 countries. Sixteen airlines operate in this segment, with Ryanair leading the way with over 14,500 departures. EasyJet and Wizz Air follow in second place. Germany ranks fifth in the country comparison, behind Spain, the United Kingdom, Italy, and France. The market share of low-cost traffic in Europe is 31 percent.

The market share of low-cost offers in total air transport in Europe remained relatively constant at around 30 percent between 2019 and 2025. In Germany, however, this share fell from 32 percent to 21.4 percent over the same period. A key reason for this is the significant expansion of Ryanair’s offerings in Europe (+12 percent), while reducing them by 33 percent in Germany.

Low costs and high availability

In January 2025, a total of 2,316 weekly departures were counted in Germany by 15 low-cost airlines. This represents an increase of approximately ten percent compared to the previous year; however, this figure remains approximately 56 percent below the pre-coronavirus level of 2019. Measured by the number of scheduled departures, Eurowings is the largest provider of low-cost connections in Germany with over 900 flights, followed by Ryanair with 692 and Wizz Air with 317 flights per week.

Particularly striking is the decline in domestic low-cost traffic, where the share has fallen to approximately 15 percent. This is due, among other things, to the market exit of Air Berlin, which led to a decrease in competition, as well as an overall reduction in capacity.

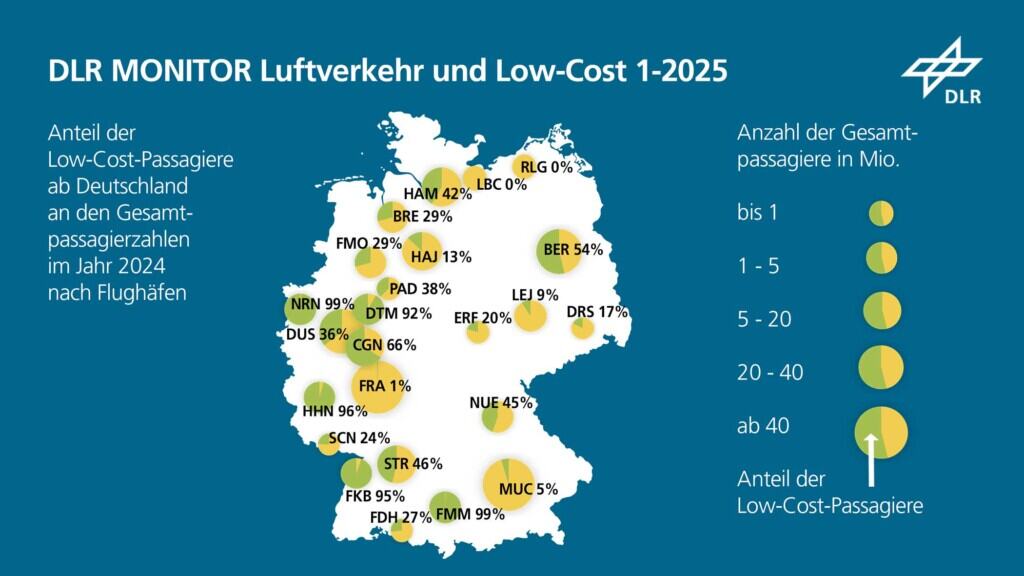

Airport landscape in Germany and neighboring countries

The share of low-cost traffic varies considerably between airports in Germany. At major hubs like Frankfurt and Munich, this share is less than five percent, while in cities like Berlin, Düsseldorf, Hamburg, Stuttgart, and Cologne, figures exceed 40 percent. Smaller airports, such as Memmingen, Weeze, and Hahn, have a particularly high low-cost share, at over 90 percent.

Berlin has the largest low-cost offering in Germany, with 547 weekly departures. Other important locations include Hamburg, Cologne, and Stuttgart. Airports close to the border, such as Eindhoven, Basel, Luxembourg, and Zurich, also offer an attractive range of low-cost connections, thus providing additional departure options for passengers from Germany, especially in regions with limited domestic flight options.

Price trends in the low-cost segment

The average gross prices for low-cost flights in Germany ranged between €67 and €130 in spring 2025. Wizz Air had the lowest average price at €67, followed by Ryanair at €80, easyJet at €86, and Eurowings at €130. Flights booked at short notice with one day’s notice cost an average of €119 to €169, while early bird prices booked three months in advance ranged from €44 to €90.

Development dynamics of business models

Although typical features such as low prices, direct online sales, and point-to-point service remain central, low-cost airlines can no longer be clearly distinguished from the rest of the market. Many airlines now pursue hybrid business models that integrate elements of traditional network or tourist airlines. For DLR’s analyses, airlines are classified as low-cost as long as they predominantly offer affordable, widely available services.

This analysis is based on data from a reference week in January 2025 and price surveys from spring 2025. Future trends in low-cost traffic will continue to be influenced by market developments in Europe and worldwide, with airlines’ adaptability being crucial to their competitiveness.

Zeppelin NT airship conquers the skies of the Lake Constance region (Zeppelin NT airship conquers the skies of the Lake Constance region)

Zeppelin NT airship conquers the skies of the Lake Constance region (Zeppelin NT airship conquers the skies of the Lake Constance region) Vietnam extends visa-free entry until 2028 (Vietnam extends visa-free entry until 2028)

Vietnam extends visa-free entry until 2028 (Vietnam extends visa-free entry until 2028) ver.di integrates TGL and strengthens aviation presence (ver.di integrates TGL and strengthens aviation presence)

ver.di integrates TGL and strengthens aviation presence (ver.di integrates TGL and strengthens aviation presence) ver.di announces strike at Stuttgart Airport (ver.di announces strike at Stuttgart Airport)

ver.di announces strike at Stuttgart Airport (ver.di announces strike at Stuttgart Airport) Turkish Aerospace and Embraer strengthen aviation industry (Turkish Aerospace and Embraer strengthen aviation industry)

Turkish Aerospace and Embraer strengthen aviation industry (Turkish Aerospace and Embraer strengthen aviation industry) Traditional brand German Airways celebrates its 70th anniversary (Traditional brand German Airways celebrates its 70th anniversary)

Traditional brand German Airways celebrates its 70th anniversary (Traditional brand German Airways celebrates its 70th anniversary)