This site is also available on:

Deutsch

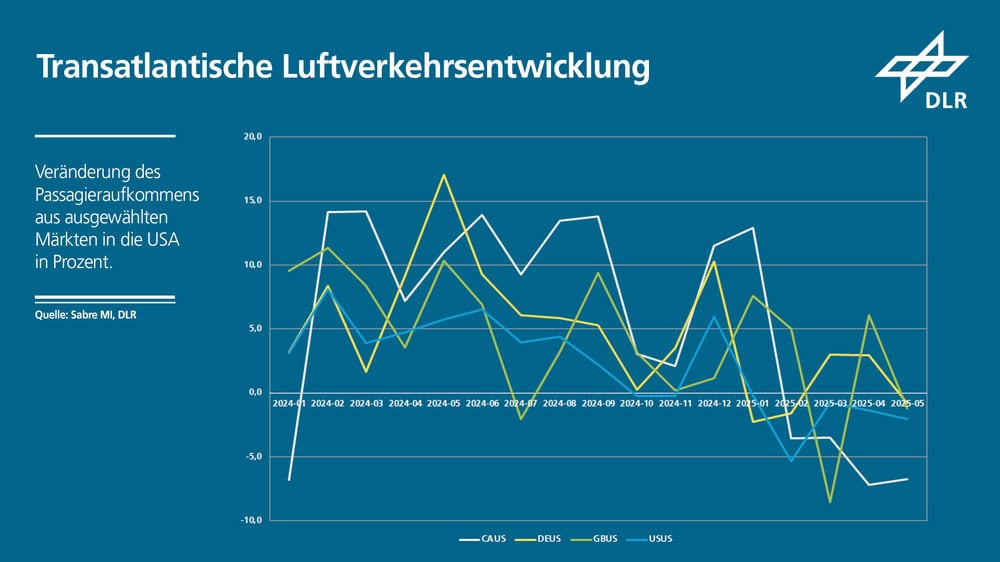

The German Aerospace Center (DLR) has examined the development of passenger numbers originating in or arriving in the USA for the period from January 2024 to May 2025. The study focused on air traffic connections between the USA and Germany, Great Britain, Canada, and China, as well as the American domestic market. From a German perspective, no long-term impact of current US policy on air traffic development can be observed.

Transatlantic traffic Germany–USA

At the beginning of 2025, there were temporary declines in transatlantic traffic (down two percent compared to January and February 2024), coinciding with increased public attention surrounding US entry requirements. Passenger numbers subsequently stabilized again at nearly the same level as in May 2024. In May 2025, approximately 500,000 direct passengers per month were registered flying from Germany to the US. In total, around ten million passengers flew directly from Germany during this period. Despite the weak economic situation in Germany, traffic between Germany and the US remains stable overall.

Developments in other markets

An international comparison reveals a heterogeneous picture. While traffic between the USA and Canada declined by up to seven percent during the period under review, routes between the USA and Great Britain experienced strong monthly fluctuations without a clear trend. Connections between the USA and China continue to follow the downward, but still clearly positive, growth trend observed since spring 2024.

In May 2025, approximately 341 million passengers traveled worldwide. This represents a slight increase of about 0.5 percent compared to the same period in 2024 and indicates an overall stable trend, despite some seasonal fluctuations. Total air traffic in Germany recorded moderate growth of about three percent compared to January to May 2024.

Airfares

Airfares also developed differently: Between Germany and the USA as well as Great Britain and the USA they rose by six to seven percent compared to January to May 2024, while prices on the Canada–USA and China–USA routes fell by eight percent and three percent respectively.

Advance bookings

Advance booking figures for the period from September 2025 to the end of the year present a mixed picture. Globally, booking levels remain stable compared to October to December 2024, at just under five percent below the previous year’s level. In the Germany–USA and Canada–USA routes, bookings declined (down five percent for December 2025 to 15 percent for November 2025 on the Germany–USA route, and down 12 percent for October 2025 to 32 percent for December 2025 on the Canada–USA route), while the UK–USA route remained stable. Advance booking figures should be interpreted with caution, as they can be influenced in the short term by price promotions, seasonal effects, and economic uncertainties. Macroeconomic factors such as the currently weak economic growth in Germany or close transport links in the case of Canada can play a role here.

Conclusion: Despite fluctuations, stable in the long term.

The current results indicate that air traffic development between the USA and Europe during the period under investigation mainly moved within the framework of general economic fluctuations.

“The US market remains of relatively minor importance to German air traffic in terms of passenger numbers,” explains Dr. Marc Gelhausen, acting head of department at the DLR Institute of Air Transport. “Markets with closer economic or transport ties to the US, particularly the UK and Canada, are more affected by the recent fluctuations. IATA data from August 2025 shows a slight overall decline in US traffic – especially in the domestic market. This is also partly reflected in the performance of the linked markets of the UK and Canada.”

Note: The current DLR analysis is based, among other things, on data from the Sabre MI analysis platform and supplementary information from the International Air Transport Association (IATA) on global market developments. The figures given refer to passengers per flight segment (or “legs”). Therefore, the figures pertain to a single flight segment and not to entire journeys. For example, a flight from Frankfurt to New York is counted as one flight segment – even if the passenger previously flew from Berlin to Frankfurt. Seasonal effects were taken into account by comparing identical time periods (January to May 2024 and 2025, respectively). The figure for global passenger volume in the section “Developments in other markets,” however, refers to total journeys including transfers.